We all know the dismal figures for the lack of women on boards and the rarity of female investors, now the attention has turned to the number of women receiving funding.

In honour of International Women’s Day last week, the UK treasury launched an Investing in Women Code, forcing banks and investors to distribute funding with gender balance in mind. That’s after a government commissioned report, found that female entrepreneurs typically start businesses with half as much capital as men.

It’s welcome news that this issue is being addressed. But how did we get to such an imbalance in the first place? As an investor in the US and UK businesses I know only too well that companies unquestionably lose out by choosing not to focus on diversity.

The challenges in increasing diversity are difficult even when there is a genuine goal to do so. At Storm Ventures, we aim to work with portfolio companies that embrace and understand the value of diversity. After all, a culture that values diversity makes a stronger business and will ultimately make us more successful as investors.

When I started in venture capital almost 20 years ago, there were only a handful of woman-identifying investors and founders. While I want to believe much has changed, recent figures, reported in the FT, showed that out of almost 2,000 founders who received venture funding, only 9% were women. That’s a tiny increase in two decades!

In the US, organisations like AllRaise and Athena Alliance are addressing this problem of diversity. The former aims to increase diversity in the ranks at technology investors. The latter helps to connect successful super smart experienced women with companies that need their talent on boards.They are important resources to help push this debate, to educate and most importantly provide platforms to take action.

Coco Brown is at the helm of Athena Alliance. Her work gives me hope for a different future in terms of diversity: “Building diversity at executive level and board level are really important.” says Brown. “Only the largest public companies have made much of an improvement over the past 10 years in this realm, and while there is still far for those companies to go, the stats with respect to newly-minted, small-cap and mid-cap public companies, and private companies are far worse.”

How can we change things? It is incumbent on early stage investors to raise the diversity issue to entrepreneurs (if it’s not already a priority), because once a culture is set, it can be very hard to induce change and create impact in the future. Think about it – not many people want to be the only woman or the only minority engineer on a team, for example. And if you are a white male thinking ‘this is never the case,’ ask yourself – have you ever been on a team without any other white males?

There is an ecosystem of investors and founders and oversight. It is rigged to a large degree to maintain status quo in both racial and gender diversity. We all have a bias towards our own networks, thus the desire to move quickly and hire outside of our known networks can compound the hiring bias. The fact that most money in venture capital goes to male founders further compounds the problem. AllRaise cites that only 15% of capital goes to teams with at least one woman founder, which is a massive gap compared to their men counterparts.

It is interesting that across Europe the numbers are similar. The FT article mentioned above claims that in the UK, two-thirds of venture funds do not have a single woman partner. While it is difficult to make exact comparisons without more context on data, in the US, the numbers seem worse with almost three-quarters of firms without one woman partner. “Venture capitalists lose by ignoring women entrepreneurs”; the article claims, so they do so at their own peril.

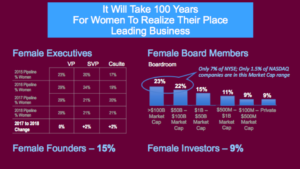

According to McKinsey and LeanIn.org who have been tracking women’s progress in executive ranks, in four years from 2014 to 2018 women have moved only 6 percent to 29% of VP roles, and only one percent to to 21% of SVP roles, and four points to 21% in C-Suite roles. In terms of board seats, while women hold 22-23% of these in companies with market caps above $50B, that only represents 7% of NYSE companies and 1.5% of NASDAQ companies. In the masses of smaller revenue companies women hold between 9% and 15% of board seats (data from The Business Journal 2018 research).

Graphic from Athena Alliance

We need to fix this. Yet, even the best efforts to progress will take a while to pay off because we are so far behind. While not ignoring the long-term battle, we must also focus on how we can make the greatest impact today. Those companies with all-male boards, all-male executive teams (and maybe even all-male workforce), must make it an imperative to onboard the talented women and diverse candidates that we already know are aplenty. We just have to shift our methods and expand our searches outside of our immediate networks.

What will accelerate this pace of change? Connecting top female leaders into the power networks that decide who gets board seats and executive roles, for starters. Then continuing to nurture those relationships and building diversity into the entire organisational design. For private companies, that’s largely the founder and venture community.

The secret is not to wait until there is an open seat, but to engage women leaders with your firm and provide them with a platform to be thought-leaders, speakers at your events, voices of the customer and sounding boards and credibility builders for potential investments. In this way, women will become empowered and known in the way men already are: for their value, as opposed to the superficial attributes we look for in resumes. Organisations like Athena know this and are acting as the power brokers for women, introducing them to domains that have been largely unknown to them until now.

It’s not that our networks aren’t a good source of quality talent, it’s that they don’t offer us the diversity to select the best talent for the modern world. Focus on enhancing your venture power network with diverse people in general, and you will find there will be many diverse outstanding people to work with when the time comes to fill an executive role or board seat.

Ryan Floyd is founding MD of Storm Ventures, a VC firm investing in tech start-ups all around the world.